DPWI Deputy Minister Noxolo Kiviet with Agrément South Africas board chairperson Dr. Initial Form 990-PF by former public charity.

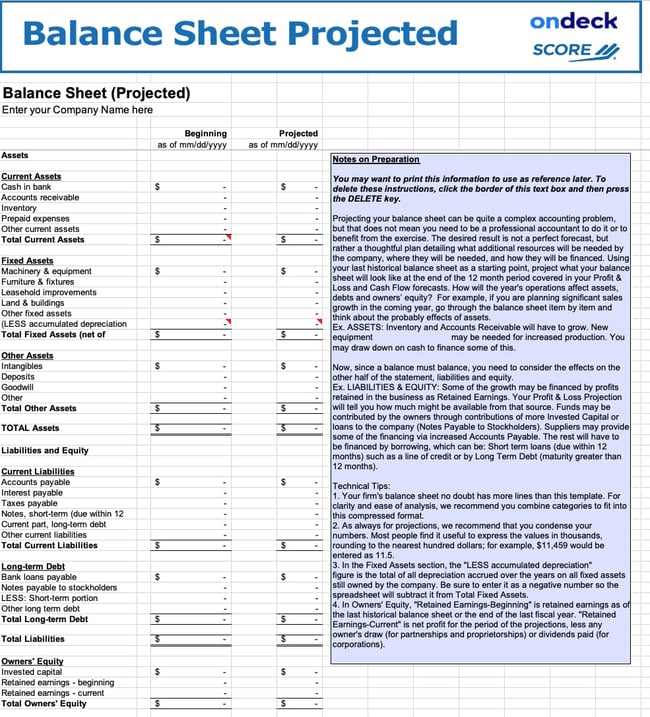

Projected Balance Sheet Bowraven Limited Small Business Software Solutions

When a credit adjustment B2 has been processed a Detailed Adjustment Statement DAS is sent to the importer to advise the amount of the credit has posted to the importer accountThe credit will.

. Director Z has the. Any amounts left owing after these priority amounts are treated as an ordinary unsecured claim along with other unsecured creditors eg. Note to 537106a6.

Statement Date means the last date of the statement period for which Your Account statement is produced. We sell retrofit solar energy systems to customers and channel partners and also make them available. Jeffrey Mahachi and the entitys Corporate Manager Ms Mantu Dlamini during the DMs visit to the entity.

From the companys perspective there is now a huge fat credit balance owing to the shareholderdirector on the balance sheet. For a hearing at the discretion of the hearing officer. Liquidation is the process in accounting by which a company is brought to an end in Canada United Kingdom United States Ireland Australia New Zealand Italy and many other countriesThe assets and property of the company are redistributed.

Critical Illness coverage can pay up to 1000000 with a maximum of 500000 towards. Authorizes the Board to prescribe a limit on the amount of short-term debt including off-balance sheet exposures that may be accumulated by bank holding companies with total consolidated assets of 50 billion or more or. A continuance request for a conference is granted or denied at the discretion of the DRS director or designee.

63 For the amount of any dividend that the directors may declare payable in money they may declare a stock dividend and issue therefor shares. If you are filing Form 990-PF because you no longer meet a public support test under section 509a1 and you havent previously filed Form 990-PF check Initial return of a former public charity in Item G of the Heading section on page 1 of your return. Directors and their spouses or relatives are excluded employees and are not entitled to any priority retrenchment pay for the period they are a director spouse or relative of a director.

Often directors may wish to pay personal expenses from the business bank account. Completed working sheet to the director or employee. If the total balance is due within a year the company may consider the loan a current asset on its balance sheet.

Business Credit Living Benefit Insurance 1 provides critical illness and disability coverages and can pay a benefit towards the outstanding balance 2 of your insured business credit products if the insured person 1 experiences a covered critical illness 1 or becomes totally disabled 1. Column ABeginning of year. Liquidation is also sometimes referred to as winding-up or dissolution although dissolution technically refers to.

B Maximum balance on either 5 April 2022 or date loan was discharged whichever is earlier C Total A B D Divide C by 2 E Number of complete tax. Deduct the amount of taxes to be withheld from the student loan repayment benefit before the balance is issued as a loan payment to the holder of the loan. Amount of interest paid was less than interest at the official rate.

Notes to financial statement. If the loan term exceeds one year the loan would be considered a long-term asset on the company balance sheet. Column BEnd of year.

Include notional loan benefits of shares. Contact the Internal Revenue Service for further details concerning these options as well as the tax withholding implications of payments under this part. We have also develop ed software capabilities for remotely control ling and dispatch ing our energy storage systems across a wide range of markets and applications including through our real-time energy trading platform.

3 As defined in the Certificate of Insurance. As with a traditional loan employees are expected to repay these loans to their employer. Importers requesting instant refunds.

Contact ARL Support with questions or concerns. A Unless a director complies with the applicable standards for conduct described in Section 33-31-830 a director who votes for or assents to a distribution made in violation of this chapter or the articles of incorporation is personally liable to the corporation for the amount of the distribution that exceeds what could have been distributed. Subject to federal income tax on an item of income or deduction but that is required to file a Form 990-T solely due to owing a section 6033e2 proxy tax does not have to request consent to change its method for reporting the item.

Director means the Director appointed under section 278 of the Business Corporations Act. Once the arrears balance falls below 2 months the defendants status with the consumer credit bureau agencies will change from delinquent to current. And for a court hearing.

Director Z is a shareholderdirector in Company ABC and his loan account has a debit balance of R23 500. For more information visit Commercial Payments and Accounts. Before filing Form 990-PF for the first time you may want to go to IRSgovEO for the.

Average Daily Balance is calculated by adding the credit card account balance each day and dividing that total by the number of days in the statement period.

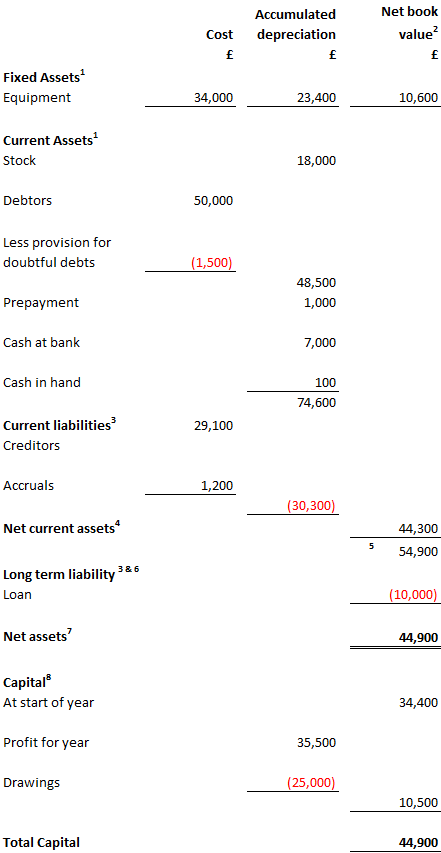

Source Accounting Understanding Your Accounts

Director S Loan Account Lending Your Company Money Inniaccounts

Insights European Gateway Eg Newsroom

What Are Accounts Receivable Bdc Ca

Insights European Gateway Eg Newsroom

Understanding Company Accounts Corporate Watch

Common Size Balance Sheet Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Balance Sheet Example The Law Student Blog

Balance Sheet Explained Maslins Accountants Maslins Accountants

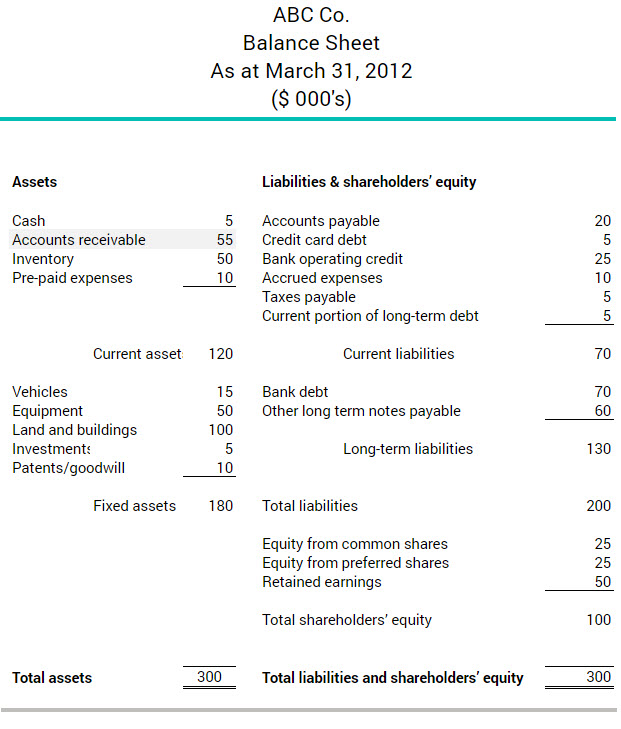

Balance Sheet Central Africa Tax Guide

Financial Statements 101 How To Read And Use Your Balance Sheet

How To Put Balances To Manager S Profit Loss Account Items Manager Forum

3 Amount Owing To Directors The Amount Due To Directors Are Unsecured Interest Course Hero

Understanding Company Accounts Corporate Watch

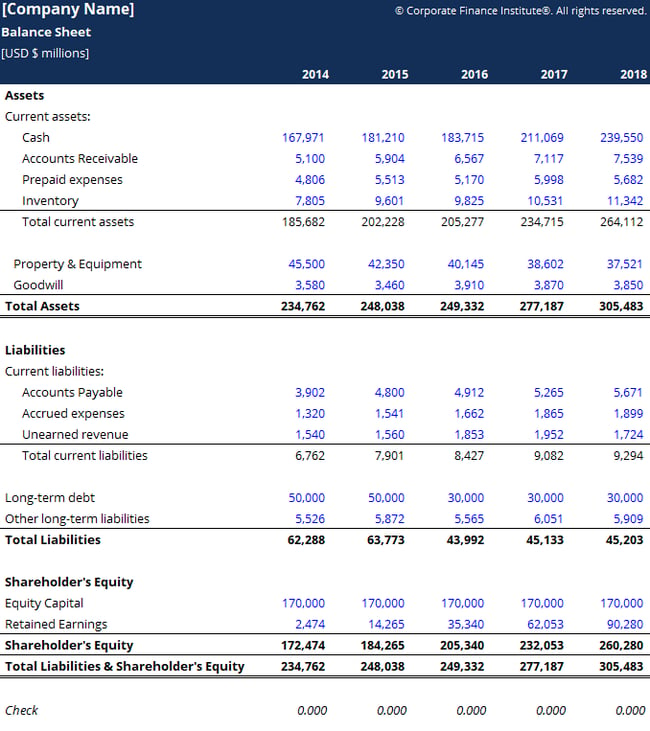

Balance Sheet Ratios Types Formula Example Accountinguide